Buying your first home is such an exciting adventure, especially in the beautiful and diverse landscape of Colorado. Known for its breathtaking mountains, lively culture, and friendly communities, Colorado has so much to offer—but it can also feel overwhelming at times. If you’re stepping into the world of home buying for the first time, it’s completely normal to have a mix of excitement and anxiety. But rest assured, you’re not navigating this journey by yourself!

At Morghan Jabusch Luxury Real Estate, we’re here to help. We know firsthand the unique challenges that come with finding your dream home in Colorado, and we’re committed to making this experience as smooth and enjoyable as possible. This guide is packed with practical tips and insights to help you navigate the process confidently and find a place that truly feels like home.

Get Pre-Approved for a Mortgage

Before you dive into searching for your dream home, getting pre-approved for a mortgage is a smart first step.

Understanding Pre-Approval: Pre-approval is more than just filling out a form; it involves a detailed look at your finances. Lenders will check your credit history, verify your income, and assess your debts. This gives you a clear idea of how much you can afford and provides you with an official letter that shows sellers you’re a serious buyer.

Utilizing the Advantages of Pre-Approval:

- Clarity on Your Budget: Knowing your price range helps you focus on homes that fit your financial situation, preventing the heartache of falling in love with a property that’s out of reach.

- Stronger Position in Negotiations: In a competitive market like Aspen or Vail, having a pre-approval letter can make your offer stand out. It shows sellers that you mean business and are ready to make a move.

- Smoother Closing Process: Since pre-approval means much of the paperwork is done, you can expect a quicker closing time, which is especially beneficial in fast-moving markets

Exploring Different Mortgage Options: Take the time to understand the various mortgage types available. Fixed-rate mortgages offer stability with predictable payments, while adjustable-rate mortgages may come with lower initial rates. Each option has its pros and cons, so it’s worth doing your homework to help you make a well-informed decision.

Set a Realistic Budget

Setting a realistic budget is crucial when diving into the Colorado housing market.

Considering Total Costs: Remember, the purchase price isn’t the only expense. You must also factor in these additional costs:

- Monthly mortgage payments: Calculated based on your pre-approved loan amount.

- Property taxes: These can vary significantly based on location, so it’s important to know what to expect in your desired area. Researching specific tax rates is essential.

- Home insurance: Get multiple quotes to find the best insurance rates, as they can vary widely depending on location and the type of home.

- Homeowners Association (HOA) fees: Many luxury properties, particularly in resort areas, come with HOA fees. These fees can cover maintenance and community amenities, so make sure to keep this in mind.

Budgeting for Maintenance: Owning a home means being prepared for ongoing expenses. A good rule of thumb is to set aside 1% to 3% of your home’s value each year for maintenance and repairs. This way, you'll be prepared for any unexpected challenges that may arise—ensuring your property’s excellent condition and safeguarding your investment.

Utilizing Budgeting Tools: Consider using budgeting apps or spreadsheets to track your finances. These tools can help you see where your money goes and ensure you stay on track as you navigate the home-buying process.

Research the Neighborhood

Selecting the right neighborhood is just as crucial as finding the ideal home. Take the time to research the areas you’re interested in.

Community Features:

- Proximity to Amenities: Think about how close you want to be to schools, shops, restaurants, and recreational activities. For example, Aspen is known for its vibrant arts scene and outdoor adventures, making it a great spot for those who love culture and nature. Living close to these amenities can enhance your quality of life and provide convenience.

- Future Development Plans: Look into any planned developments that could affect property values or your quality of life. This can include new commercial developments, transportation projects, or community enhancements. Understanding the long-term vision for the area can give you peace of mind.

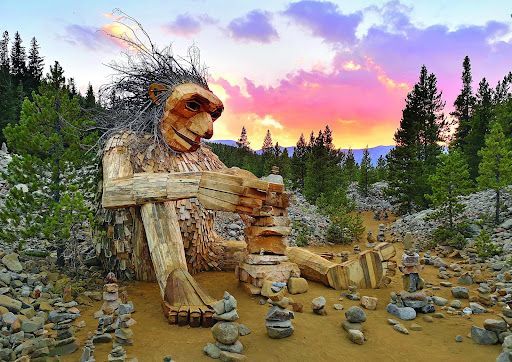

Local Lifestyle: Consider what lifestyle each neighborhood offers. Breckenridge offers year-round recreational opportunities and is perfect for outdoor enthusiasts, while Vail boasts luxurious shopping and dining options that offer an upscale experience. Finding a place that matches your lifestyle preferences is key to feeling at home.

School District Ratings: If you have kids or plan to, research school district ratings. Quality education can significantly impact property values and your family’s happiness and overall satisfaction with the neighborhood.

Neighborhood Safety: Check crime statistics and community engagement levels. A safe neighborhood enhances your living experience and is often a priority for many luxurious buyers. Engaging with local community groups can provide valuable insights into safety and community dynamics.

Don’t Skip the Home Inspection

Once you find a property that feels right, don’t skip the home inspection. This step is essential in ensuring you’re making a smart investment.

Knowing the Importance of Inspections: A home inspection can reveal potential issues—like structural problems, pest infestations, or faulty wiring—that could lead to expensive repairs later. This is especially important for luxury homes, where the stakes are higher. An inspection is a safeguard against unforeseen issues.

Choosing the Right Inspector: Look for an inspector who specializes in luxury properties. They’ll know what to look for specifically in high-end properties, ensuring a thorough evaluation. Consider asking for recommendations from your real estate agent or friends who have recently purchased homes.

Understanding Inspection Reports: Discuss the findings with your real estate agent to determine how to proceed. If serious issues arise, you can negotiate repairs or even reconsider the purchase.

Including Contingencies in Offers: Make sure to include an inspection contingency in your offer. This clause gives you the option to back out or renegotiate if the inspection reveals significant problems, providing peace of mind as you move forward.

Be Ready to Compromise

As a first-time buyer, you might have a wish list of must-haves for your new home. That said, be ready to make some compromises on specific features.

Must-Haves vs. Nice-to-Haves: Identify what’s truly essential—like location or the number of bedrooms—and what you can be flexible about, such as aesthetics or yard size. Understanding these priorities can help you streamline your search and help you focus on what truly matters.

Exploring Various Property Types: The luxury market offers an array of properties, from stunning single-family homes to chic condos and townhomes— each option comes with unique benefits and drawbacks. So keep an open mind and you might find something unexpected that fits your needs perfectly.

Embracing the Journey: Remember, finding the right home can take time. Be open to reevaluating your priorities as you explore the market. Flexibility can lead you to hidden gems that resonate with you.

Patience in Competitive Markets: In sought-after areas like Vail and Aspen, the market can be fast-paced. Stay patient; your dream home is out there. Sometimes stepping back for a moment can offer you clarity and fresh perspective.

Understand the Closing Costs

When budgeting for your new home, it’s vital to understand the closing costs involved in the transaction.

Identifying Different Types of Closing Costs: Knowing the various closing costs upfront can help you avoid surprises and plan your finances more effectively. These costs typically range from 2% to 5% of your home’s purchase price and may include:

- Title insurance

- Appraisal fees

- Recording fees

- Escrow fees

- Home warranty (optional)

Negotiating Closing Costs: In most cases, you can negotiate with the seller to cover part of the closing costs. This is particularly useful in a buyer’s market, where sellers may be more willing to accommodate such requests.

Requesting for Estimates and Planning: Ask your lender for a Good Faith Estimate (GFE) early in the process. This document outlines estimated closing costs and helps you budget accordingly. Having a clear idea of what to expect can reduce anxiety as you approach the final steps of the purchase.

Understanding the Timeline for Closing: Knowing the timeline for closing helps you manage your finances and ensures you’re ready for this final step in the home-buying process. Stay in close contact with your real estate agent and lender to keep things on track, and address any issues that arise.

Explore Home Financing Options

Understanding your financing options is key to making informed decisions about your home purchase.

First-Time Homebuyer Programs: Colorado offers various programs for first-time buyers. Research these options, as they may provide down payment assistance or favorable loan terms that could ease your financial burden.

Types of Loans:

- Conventional Loans: Often preferred for luxury home purchases, these loans typically require a higher credit score and a more substantial down payment.

- FHA Loans: These may have lower credit requirements but often come with mortgage insurance, which adds to your monthly expenses.

- VA Loans: If you’re a veteran, you might qualify for favorable terms, including no down payment. These loans offer an excellent option for eligible buyers seeking to enter the real estate market.

Working with a Mortgage Broker: Consider teaming up with a mortgage broker who can help you find the best financing options tailored to your unique financial situation. Their expertise can provide insights into loan products and rates, streamlining the financing process.

Interest Rates and Terms: Research current interest rates and loan terms. Even a small difference in rates can lead to significant savings over time, so it’s worth shopping around and comparing offers.

Partner with a Trusted Real Estate Agent

Finally, partnering with a trusted real estate agent can make all the difference in your home-buying experience.

Benefits of a Real Estate Agent: An experienced agent knows the ins and outs of the local market. They can help you find the best neighborhoods, assess property values, and even negotiate on your behalf.

Choosing the Right Agent: Look for someone who specializes in luxury real estate and knows Colorado well. Ask for referrals and check reviews to find a professional who aligns with your needs and values.

Clear Communication: Establish open communication with your agent. Share your priorities and concerns, and don’t hesitate to ask questions. A strong partnership ensures you feel supported throughout the buying process.

Trust Their Expertise: Your agent is a valuable resource. Trust their insights and recommendations, whether negotiating offers or advising on property conditions. Their expertise can help you steer clear of common mistakes and guide you to make well-informed choices.

FAQs for First-Time Homebuyers in Colorado

As you embark on your home-buying journey, it’s natural to have questions. Here are some frequently asked questions that many first-time buyers in Colorado often ponder.

What is the average time it takes to buy a home in Colorado?

The timeline can vary widely depending on the market conditions, your readiness, and the specific property you're interested in. In general, the timeline for buying a home can range from a few weeks to several months. Once you have your financing in place, you can expect the home search to take anywhere from a few days to several weeks, followed by the closing process, which typically lasts 30 to 45 days.

Are there specific homebuyer programs in Colorado for first-time buyers?

Yes! Colorado offers various programs designed to assist first-time homebuyers. These include down payment assistance programs, grants, and favorable loan terms through the

Colorado Housing and Finance Authority (CHFA). Researching these programs can help ease the financial burden of purchasing a home.

What key factors should I consider during a home inspection?

A thorough home inspection can reveal hidden issues. Key areas to focus on include:

- Structural integrity: Look for signs of settling or damage in the foundation and framing.

- Roof condition: Check for leaks or aging shingles.

- Plumbing and electrical systems: Ensure these are up to code and functioning properly.

- HVAC systems: Assess their age and condition, as replacing these can be costly.

- Signs of pests: Look for evidence of termites or rodents, which can cause significant damage.

What are the typical closing costs I should anticipate?

Closing costs usually fall between 2% and 5% of the purchase price of the home. For a $600,000 home, this could mean anywhere from $12,000 to $30,000 in closing costs. It's crucial to ask your lender for a detailed estimate early on to avoid surprises.

Can I back out of a deal if I find issues during the inspection?

Yes, you can include an inspection contingency in your offer. If the inspection reveals significant problems, this contingency allows you to negotiate repairs with the seller or even back out of the deal without losing your earnest money deposit.

What’s the best time of year to buy a home in Colorado?

While homes are available year-round, the market can be more competitive during spring and summer when more listings become available. However, buying in the fall or winter can sometimes yield better deals, as fewer buyers are looking during these months.

Your journey as a first-time homebuyer in Colorado is filled with exciting possibilities. Each step—whether it’s securing financing, exploring neighborhoods, or finding the right property—brings you closer to owning a piece of this stunning state.

By following the tips outlined in this guide, you’ll be well-prepared to navigate the complexities of the real estate market. Remember, having the right support system is essential. At Summit Colorado Realty, we are dedicated to providing you with expert guidance and personalized service throughout the entire process.

With our experience and knowledge of the Colorado market, we can help you turn your dream of homeownership into a reality. Don't hesitate to reach out to us for any questions or to get started on your journey today. Your perfect home in the heart of Colorado awaits.

Additional Resources

To further assist you, consider exploring these additional resources:

- Local Community Guides: Learn more about neighborhoods in Aspen, Vail, Breckenridge, and Frisco.

- Mortgage Calculators: Use online tools to estimate your monthly payments and understand different loan options.

- Homebuyer Workshops: Look for workshops hosted by local real estate agents or financial institutions to gain more insights into the buying process.

By equipping yourself with knowledge and partnering with a dedicated real estate professional, you’re setting the foundation for a successful and fulfilling home-buying experience in Colorado.

Feel free to contact us anytime—together, we can find the home that perfectly suits your lifestyle and aspirations. Welcome to the exciting world of homeownership!