Navigating the real estate market can be complex, especially in the high-end Colorado market, where precision and knowledge are paramount. Whether you're a seasoned investor eyeing Aspen's exclusive estates, a first-time homebuyer dreaming of a chalet in Vail, or a seller looking to position your Breckenridge property for the best return, familiarizing yourself with industry jargon is essential for making informed decisions and achieving your real estate goals. This comprehensive guide breaks down essential real estate terms, empowering you to confidently navigate the Colorado luxury market, including vibrant towns like Aspen, Breckenridge, Vail, and Frisco.

Frequently Searched Real Estate Terms

These are the fundamental terms every buyer and seller should understand to navigate the real estate process efficiently. This section covers essential concepts like appraisals, closing costs, and escrow, providing a solid foundation for real estate transactions.

1. Appraisal

These are the fundamental terms every buyer and seller should understand to navigate the real estate process efficiently. This section covers essential concepts like appraisals, closing costs, and escrow, providing a solid foundation for real estate transactions.

2. Closing Costs

Closing costs encompass all the fees and expenses associated with finalizing a real estate transaction, excluding the property's price. These can include loan origination fees, title insurance, escrow fees, and various taxes. Buyers and sellers need to understand these costs to avoid surprises at the closing table.

3. Comparative Market Analysis (CMA)

A CMA is a report prepared by a real estate agent to help determine a property’s market value based on similar recently sold properties in the area. It includes details about each comparable property and provides a recommended listing price.

4. Contingency

A contingency is a contractual condition that must be met for a real estate agreement to become binding. Common contingencies include financing, home inspection, and appraisal, allowing the buyer to withdraw from the contract if conditions aren't satisfied without penalties.

5. Down Payment

The down payment is the upfront portion of the purchase price that a buyer pays in cash. It is usually expressed as a percentage of the total selling price and can significantly impact the terms of the mortgage.

6. Earnest Money Deposit

A buyer makes This deposit to show their commitment to purchasing a property. It is typically held in escrow and applied to the down payment or closing costs. If the buyer fails to fulfill the contract terms, they may forfeit this deposit.

7. Escrow

Escrow is a neutral third party that holds funds or documents during a real estate transaction, ensuring both parties fulfill their obligations before the transaction is finalized.

8. Fixed-Rate Mortgage

A mortgage with a fixed interest rate for the entire term of the loan. This provides predictable monthly payments, making it a popular choice for buyers looking for stability.

9. Home Inspection

A home inspection is a thorough examination of a property’s condition, usually performed by a licensed inspector before the sale is finalized. It identifies any potential issues or repairs needed, giving buyers a clear picture of the property’s state.

10. Listing Agreement

A contract between a seller and a real estate agent that authorizes the agent to market and sell the property. It outlines the terms of the arrangement, including the commission rate and the duration of the listing period.

Essential Terms for Luxury Buyers and Sellers

Luxury real estate has its own unique language. This section delves into terms particularly relevant to high-end property transactions, such as exclusive listings, luxury amenities, and pre-approval. Knowing these terms helps buyers and sellers in the luxury market make well-informed decisions.

11. Deed Restrictions

Deed restrictions are legal limitations placed on the use of a property by the seller. They can include rules about building size, architectural style, property use (residential vs. commercial), and even landscaping. These restrictions are common in high-end, exclusive neighborhoods like Colorado to maintain a specific aesthetic and lifestyle.

12. Exclusive Listing

An exclusive listing is a real estate agreement in which one broker is appointed as the sole agent for the sale of a property. This can often result in a higher level of service and marketing effort, as the broker is fully dedicated to the property.

13. Homeowners Association (HOA) Fees

Homeowners Association (HOA) fees are monthly or annual charges levied by a homeowners association to maintain common areas, and amenities, and enforce community rules. These fees are prevalent in many Colorado developments and contribute to the overall value and desirability of the community.

14. Luxury Property

A luxury property typically refers to high-end real estate that is valued within the top 10% of properties on the local market. These properties often feature premium amenities, high-quality finishes, and prime locations.

15. Market Value

The price at which a property would sell in a competitive, open market. Understanding market value is crucial for pricing a property correctly and making informed buying decisions.

16. Pre-Approval

A preliminary evaluation by a lender to determine how much a buyer is qualified to borrow. Pre-approval gives buyers an advantage when making an offer, as it shows sellers they are serious and financially capable.

17. Title Insurance

A policy that protects the buyer and lender from any claims or legal disputes over the property’s ownership. It ensures that the title is clear and that the buyer has legal ownership of the property.

18. Walk-Through

A final inspection by the buyer to verify the property's condition matches the agreed-upon terms before closing. It allows buyers to verify that any requested repairs have been made and that the property is ready for occupancy.

Advanced Terms for Seasoned Investors

Investors need to grasp more sophisticated concepts to maximize their returns. This section explains advanced terms like capital gains tax, net operating income (NOI), and real estate investment trusts (REITs), equipping seasoned investors with the knowledge to enhance their investment strategies.

19. Capital Gains Tax

A tax on the profit made from the sale of a property. Understanding the implications of capital gains tax is vital for investment strategies and financial planning.

20. Cash Flow

The net amount of cash generated from a rental property after all expenses are paid. Positive cash flow is a key indicator of a successful investment, providing regular income to the investor.

21. Equity

The difference between a property's current market value and the remaining mortgage amount. Building equity is a primary goal for homeowners and investors, as it represents the owner's financial interest in the property.

22. Net Operating Income (NOI)

It is the total income minus operating expenses, excluding mortgage payments and taxes. NOI helps investors evaluate the performance of their properties and assess their investment profitability.

23. Property Management

The oversight and administration of residential or commercial properties on behalf of owners to maintain and maximize their value. It includes tasks such as tenant relations, maintenance, rent collection, and property upkeep, ensuring properties operate smoothly and profitably.

24. Real Estate Investment Trust (REIT)

A company that owns, operates, or finances income-producing real estate. REITs offer a way for investors to gain exposure to real estate without directly owning properties, providing liquidity and diversification.

Common Terms for First-Time Buyers

First-time homebuyers can find the real estate market overwhelming. This section simplifies the process by defining key terms like adjustable-rate mortgage (ARM), buyer’s agent, and homeowner’s association (HOA), making it easier for newcomers to understand and navigate their first purchase.

25. Adjustable-Rate Mortgage (ARM)

A mortgage with an interest rate that changes periodically based on a benchmark index. This can result in lower initial payments but higher payments if the rate increases.

26. Amortization

The gradual repayment of a loan through regular installments that cover both principal and interest, reduces the loan balance over time.

27. Buyer’s Agent

A real estate agent who represents the interests of the buyer in a transaction. They help find properties, negotiate offers, and navigate the buying process.

28. Homeowner’s Association (HOA)

An organization that manages a residential community. HOAs enforce rules and regulations and collect fees to maintain common areas and amenities.

29. Lease Option

A lease option is a contractual agreement that allows a tenant to lease a property with the option to purchase it at a later date. It provides flexibility for potential buyers who may not be ready to commit immediately but want the opportunity to buy in the future.

Common Terms for Sellers

Selling a property involves understanding various terms that can impact the transaction. This section focuses on common seller-related terms like For Sale By Owner (FSBO), multiple listing service (MLS), and staging, helping sellers prepare and market their properties effectively.

30. For Sale By Owner (FSBO)

A property sold directly by the owner without representation by a real estate agent. This can save on commission fees but requires the owner to handle all aspects of the sale.

31. Multiple Listing Service (MLS)

A database used by real estate professionals to list properties for sale and facilitate transactions. It provides extensive details about each property, making it a valuable tool for both buyers and sellers.

32. Short Sale

A transaction where a property is sold for less than the remaining mortgage balance. This typically happens when the homeowner is experiencing financial hardship and can no longer afford the mortgage payments. The lender agrees to accept the proceeds from the sale, even if it's less than the total debt, to avoid the more costly foreclosure process.

33. Staging

The process of preparing a property for sale to enhance its appeal to potential buyers. Staging can involve decluttering, rearranging furniture, and making cosmetic improvements to attract buyers.

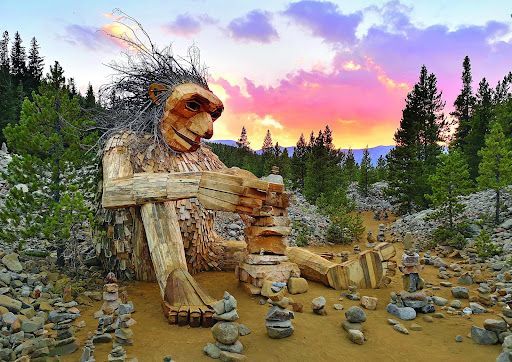

Colorado Luxury Real Estate Market Terms

Colorado’s real estate market has specific terminology reflecting its unique attributes. This section highlights terms like ski-in/ski-out, estate property, and luxury amenities, providing insights into what makes Colorado properties distinctive and desirable.

34. Ski-in/ski-out

A ski-in/ski-out property offers direct, unhindered access to ski slopes. This means winter sports enthusiasts can conveniently ski straight from their doorstep and return without needing additional transportation.

35. Estate property

An estate property is a large, luxurious residence typically situated on expansive grounds. These properties often embody privacy, exclusivity, and a prestigious lifestyle, commonly found in affluent neighborhoods.

36. Luxury amenities

Luxury amenities are high-end features and facilities that elevate a property's standard of living. They often include outdoor retreats like private pools and spas, indoor comforts such as home theaters and wine cellars, and modern conveniences like smart home technology and elevator access.

37. Cap rate

The capitalization rate, or cap rate, is a financial metric used to evaluate the potential profitability of income-generating real estate. It compares a property's net operating income (NOI) to its purchase price, with higher cap rates generally indicating more attractive investment opportunities.

38. Cash-on-cash return

Cash-on-cash return measures the annual profitability of a real estate investment based on the initial cash invested. It compares the property's annual before-tax cash flow to the total cash outlay, providing investors with a direct measure of investment efficiency.

39. Elevation Premium in Colorado Real Estate

An elevation premium refers to the increased value of a property due to its higher altitude. This is particularly pronounced in mountainous regions like Colorado. Properties situated at higher altitudes in Colorado typically command higher prices due to several factors like panoramic views, ski access, climate and air quality, and prestige. For more information on

Breckenridge altitude check out our blog.

40. 1031 exchange

A 1031 exchange allows investors to defer capital gains taxes by reinvesting the proceeds from the sale of one investment property into another qualifying property. To qualify, the properties must be held for investment purposes and meet specific IRS criteria.

Comprehensive Real Estate Glossary

Here is a broader glossary of real estate terms that encompasses everything you might encounter during your buying or selling journey. This section serves as a handy reference guide, covering a wide range of terms from amortization to zoning, ensuring you are well-prepared for any real estate situation.

- Amortization: Gradual reduction of loan debt through regular payments.

- Appreciation: Increase in a property's value over time.

- Assessed Value: The dollar value assigned to a property by a taxing authority to calculate property taxes.

- Balloon Mortgage: A loan with initial small payments and a large final payment, typically used to finance short-term investments or properties.

- Bridge Loan: Short-term loan used until permanent financing is secured.

- Deed: A legal document transferring property ownership.

- Depreciation: The reduction in a property's value over time, influenced by factors such as wear and tear, market fluctuations, or obsolescence.

- Dual Agency: When a real estate agent represents both the buyer and seller in a transaction, with potential conflicts of interest regulated by state laws.

- Easement: A right to cross or use someone else's land for a specific purpose.

- Encumbrance: A claim against a property, such as a mortgage or lien.

- Fair Market Value: The price a willing buyer would pay a willing seller.

- Foreclosure: The process by which a lender takes control of a property due to unpaid mortgage.

- Grant Deed: A deed that transfers property ownership and implies certain guarantees.

- Lien: A legal claim against a property for unpaid debts or obligations, which may affect the property's sale or refinancing.

- Principal: The original amount borrowed for a mortgage or loan, excluding interest.

- Private Mortgage Insurance (PMI): Insurance required for conventional loans with less than 20% down.

- Refinancing: Replacing an existing mortgage with a new loan, often to secure better terms or lower interest rates.

- Right of First Refusal: A contractual right that gives a party the option to purchase a property before it is offered to others.

- Survey: A measurement of property's dimensions and legal boundaries, including the location of buildings and other improvements.

- Zoning: Local government regulations on how properties can be used.

Understanding these real estate terms will not only boost your confidence but also enhance your ability to navigate Colorado's luxury property market with ease. Keep this glossary handy as a go-to resource for all your real estate needs—whether you're exploring properties in

Aspen, seeking the tranquility of a mountain home in

Breckenridge, looking into the

sophisticated communities of Vail, or considering investment opportunities in the growing market of

Frisco.

For personalized advice and expert guidance, connect with

Summit Colorado Realty today. We specialize in helping clients find their perfect property across Aspen, Breckenridge, Vail, Frisco, and beyond.